Filed Pursuant to 424(b)(3)

Registration No. 333-214391

Prospectus

Matinas BioPharma Holdings, Inc.

10,382,500 Shares

Common Stock

This prospectus relates to the offer for sale of up to an aggregate of 10,382,500 shares of common stock underlying warrants of Matinas BioPharma Holdings, Inc. by the selling stockholders named herein. We are not offering any securities pursuant to this prospectus.

Our common stock is listed for quotation on the OTCQB Market operated by OTC Markets Group, Inc. (or OTCQB) under the ticker symbol “MTNB.” On November 15, 2016, closing price of our common stock was $1.61.

Following the effectiveness of the registration statement of which this prospectus forms a part, the sale and distribution of securities offered hereby may be effected in one or more transactions that may take place on the OTC Bulletin Board and/or OTCQB Market, including ordinary brokers’ transactions, privately negotiated transactions or through sales to one or more dealers for resale of such securities as principals, at market prices prevailing at the time of sale, at prices related to such prevailing market prices or at negotiated prices. Usual and customary or specifically negotiated brokerage fees or commissions may be paid by the selling stockholders. See “Plan of Distribution.”

Certain of the selling stockholders and intermediaries through whom such securities are sold may be deemed “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation.

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our common stock is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on page 7 of this prospectus for a discussion of information that should be considered before making a decision to purchase our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 18, 2016.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information different from or in addition to that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Additional risks and uncertainties not presently known or that are currently deemed immaterial may also impair our business operations. The risks and uncertainties described in this document and other risks and uncertainties which we may face in the future will have a greater impact on those who purchase our common stock. These purchasers will purchase our common stock at the market price or at a privately negotiated price and will run the risk of losing their entire investments.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market and other industry data and forecasts from publicly available information.

This summary highlights information contained in other parts of this prospectus. Because it is a summary, it does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should read the entire prospectus carefully, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

When used herein, unless the context requires otherwise, references to the “Company,” “we,” “our” and “us” refer to Matinas BioPharma Holdings, Inc., a Delaware corporation, collectively with its wholly-owned subsidiaries, Matinas BioPharma, Inc., a Delaware corporation, which we sometimes refer to herein as Matinas BioPharma, and Matinas BioPharma Nanotechnologies, Inc. (formerly, Aquarius Biotechnologies, Inc.), a Delaware corporation, which we sometimes refer to herein as Matinas Nanotechnologies.

Our Company

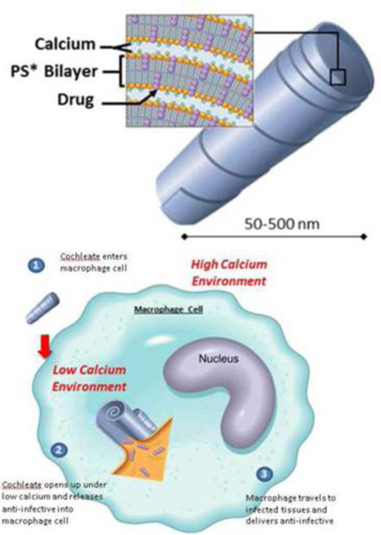

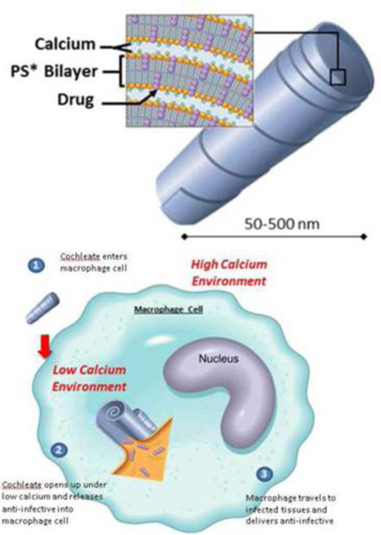

We are a clinical-stage biopharmaceutical company focused on identifying and developing safe and effective broad spectrum therapeutics for the treatment of serious and life-threatening infections. We are developing a pipeline of product and development candidates, with an initial focus on serious fungal and bacterial infections. On January 29, 2015, we completed the acquisition of Aquarius Biotechnologies Inc., whose name was subsequently changed to Matinas BioPharma Nanotechnologies, Inc. (referred to as the “2015 Merger” throughout this document), a New Jersey-based, early-stage pharmaceutical company focused on the development of differentiated and orally delivered therapeutics based on a proprietary, lipid crystal drug delivery platform called “cochleate delivery technology.”

Our proprietary cochleate delivery technology platform, licensed from Rutgers University on an exclusive worldwide basis, is designed specifically for the targeted and safe delivery of pharmaceuticals directly to the site of infection or inflammation. This innovative technology utilizes lipid-crystal nano-particle cochleates to nano-encapsulate existing drugs, which is designed to make them safer, more tolerable, less toxic and orally bioavailable. We believe this platform represents a significant innovation that may result in meaningful improvements to currently available therapies to treat numerous life-threatening diseases, including serious fungal infections and multi-drug resistant, or MDR, gram-negative bacterial infections.

Currently, we are focused on the anti-infectives market and on drug candidates which we believe demonstrate the value and innovation associated with our unique delivery platform technology. We believe initially focusing on the anti-infectives market has distinct advantages for the development of products which meet significant unmet medical need, including:

| · | a current regulatory environment which provides small development and clinical stage companies incentives and opportunities to reduce development cost and timeline to market for anti-infective drug candidates; |

| · | traditional high correlation between efficacy and safety data in preclinical animal models and the outcome of human clinical trials with these product candidates; |

| · | attractive commercial opportunities for a product differentiated in its safety profile, mode of action and oral bioavailability positioned against current therapies with significant side effects, limited efficacy and intravenous delivery resulting in lack of convenience, compliance and at a significant burden to the cost of healthcare; and |

| · | an ability to commercialize anti-infective products with a focused and cost-efficient sales and marketing organization |

| -2- |

We currently have two clinical-stage products designed for the treatment of infectious disease. Our lead product candidate is MAT 2203, a novel oral formulation of a broad spectrum anti-fungal drug called amphotericin B which uses our cochleate delivery technology. We are initially developing MAT2203 for the treatment of Candida infections and for the prevention of invasive fungal infections (IFIs) due to immunosuppressive therapy. A Phase 1a study has been completed and demonstrated that MAT2203 was generally well tolerated at all dosage levels with no serious adverse events reports and no laboratory or renal function abnormalities observed. We are currently screening and enrolling patient in a Phase 2a study of MAT2203 in collaboration with the National Institute of Allergy and Infectious Diseases, or NIAID, of the National Institutes of Health, or NIH. In the third quarter of 2016, the NIH commenced dosing patients in this Phase 2a study and, assuming the NIH meets the anticipated clinical timelines, we anticipate announcing results of this study during the first half of 2017. In addition to the Phase 2a study being conducted by the NIH, we will commence a second Phase 2 study in patients with vulvovaginal candidiasis during the fourth quarter of 2016, with results anticipated late in the first half of 2017. The U.S. Food and Drug Administration, or FDA, has granted MAT2203 designations for Qualified Infectious Disease Product, or QIDP, and Fast Track for the treatment of invasive candidiasis and invasive aspergillosis and for prophylactic treatment of invasive fungal infections due to immunosuppressive therapy. The QIDP designation, provided under the Generating Antibiotic Incentives Now Act, or the GAIN Act, offers certain incentives for the development of new antibacterial or antifungal drugs, including eligibility for Fast Track Designation, priority review and, if approved by the FDA, eligibility for an additional five years of marketing exclusivity. Fast Track designation enables more frequent interactions with the FDA to expedite drug development and review. Neither Fast Track designation nor QIDP designation change the standards for approval and we can provide no assurances that we can maintain QIDP or Fast Track designations for MAT2203 or that such designations will result in faster regulatory review. MAT2203 has also received designation from FDA as an Orphan Drug for the treatment of leishmaniasis and we expect to file for additional Orphan Drug designations for MAT2203. The orphan drug designation provides eligibility for seven years of market exclusivity in the United States upon FDA approval, a waiver from payment of user fees, an exemption from performing clinical studies in pediatric patients and tax credits for the cost of clinical research, if we maintain orphan drug designation. The seven-year period of marketing exclusivity provided through orphan designation combined with an additional 5 years of marketing exclusivity by the QIDP designations would position MAT2203 for eligibility of a total of 12 years of marketing exclusivity to potentially be granted at the time of FDA approval.

Our second clinical stage product candidate is MAT2501, an orally administered, encochleated formulation of the broad spectrum aminoglycoside antibiotic amikacin which may be used to treat different types of multidrug-resistant bacteria, including non-tubercular mycobacterial infections (NTM), as well as various multidrug-resistant gram negative and intracellular bacterial infections. Currently, amikacin cannot be absorbed enterally and must be given by intravenous, intramuscular or nebulization routes with the significant risk of nephrotoxicity and ototoxicity, which makes it an impractical choice when treating serious infections which often require long courses of therapy, often 12 to 18 months or longer. MAT2501, taking advantage of its innovative, nano-encapsulation delivery technology, is being developed to be orally administered, and is designed to be a safer and targeted therapy for improved treatment of these serious and life-threatening bacterial infections in patients, including those who are severely immunocompromised. We are initially developing MAT2501 for the treatment of NTM. NTM causes many serious and life-threatening diseases, including pulmonary disease, skin and soft tissue disease, joint infections and, in immunocompromised individuals, disseminated infection. The most common clinical manifestation of NTM disease is pulmonary, or lung, disease. NTM lung infection occurs when a person inhales the organism from their environment. There are about 50,000 to 90,000 people with NTM pulmonary disease in the United States, with a much higher prevalence in older adults, and these numbers appear to be increasing. However, NTM can affect any age group. Without treatment, the progressive lung infection caused by NTM results in severe cough, fatigue, and often weight loss. In some people NTM infections can become chronic and require ongoing treatment. Treatment may be difficult because NTM bacteria may be resistant to many common types of antibiotics. Severe NTM lung disease can have a significant impact on quality of life and can be life-threatening. We are also exploring the development of MAT2501 for the treatment of a variety of serious and acute bacterial infections, including the treatment of gram negative bacterial infections, currently the most significant unmet medical need identified by infectious disease specialists. We recently filed an Investigational New Drug (IND) application with FDA and were clear to commence Phase 1 clinical studies in January 2016. We plan to initiate the first Phase 1 study of MAT2501 during the fourth quarter of 2016. The U.S. FDA has already granted MAT2501 designations for Orphan Drug and QIDP for the treatment of non-tuberculous mycobacteria. If we maintain orphan drug and QIDP designations, the seven-year period of marketing exclusivity provided through orphan designation combined with an additional 5 years of marketing exclusivity by the QIDP designations positions MAT2501 to be eligible for total of 12 years of marketing exclusivity which may be granted at the time of FDA approval.

| -3- |

We are currently exploring strategic partnering options for our legacy cardiovascular drug, MAT9001, which has been developed and targeted to date for the treatment of very high triglycerides and MAT8800, our discovery program seeking to identify product candidates derived from omega-3 fatty acids for the treatment of non-alcoholic fatty liver disease.

Recent Developments

In July 2016, we conducted a closing for a private placement of our Series A Preferred Stock. Subsequently in August and September 2016, we conducted additional closings of the private placement. We sold an aggregate of 1,600,000 shares of our Series A Preferred Stock for an aggregate purchase price of $8.0 million.

In connection with the private placement, we filed a Certificate of Designation (the “Certificate of Designations”) with the Secretary of State of the State of Delaware to designate the preferences, rights and limitations of the Series A Preferred Stock. Pursuant to the Certificate of Designations, we designated 1,600,000 shares of our previously undesignated preferred stock as Series A Preferred Stock. The shares of Series A Preferred Stock are convertible into 16,000,000 shares of our common stock based upon the current conversion price. Please see “Descripton of Capital Stock” for a description of the terms of the Series A Preferred Stock.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock. Also, we have irrevocably elected to “opt out” of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Corporate Information

We were incorporated in Delaware under the name Matinas BioPharma Holdings, Inc. in May 2013. We have two operating subsidiaries: Matinas BioPharma, Inc., a Delaware corporation, and Matinas BioPharma Nanotechnologies, Inc., a Delaware corporation. Nereus BioPharma LLC, a Delaware limited liability company (and Matinas BioPharma’s predecessor) was formed on August 12, 2011. On February 29, 2012, Nereus BioPharma LLC converted from a limited liability company to a corporation and changed its name to Matinas BioPharma, Inc. In July 2013, Matinas BioPharma, Inc. entered into entered into a merger agreement (the “2013 Merger Agreement”) with Matinas Merger Sub, Inc., a Delaware corporation and our wholly owned subsidiary, or Merger Sub. Pursuant to the terms of the 2013 Merger Agreement, as a condition of and contemporaneously with the initial closing of the 2013 Private Placement, Merger Sub merged (the “2013 Merger”) with and into Matinas BioPharma and Matinas BioPharma became a wholly owned subsidiary of ours. After consummation of the Merger transaction, the management of Matinas BioPharma became the management of Holdings and the board representatives consisted of four former Board members of Matinas BioPharma and Mr. Adam Stern as the Aegis Capital Corp. nominee. Because Holdings was formed solely to effect the 2013 Merger and the 2013 Private Placement, with no operations, and assets consisting solely of cash and cash equivalents, we accounted for the 2013 Merger as a reverse acquisition. The legal acquirer Matinas BioPharma becomes the successor entity, and its historical results became the historical results for Holdings (the legal acquirer and the registrant). On January 29, 2015, we acquired Aquarius Biotechnologies Inc., whose name was subsequently changed to Matinas BioPharma Nanotechnologies, Inc.

| -4- |

Our principal offices are located at 1545 Route 206 South, Suite 302, Bedminster, New Jersey 07921. Our web address is www.matinasbiopharma.com. Information contained in or accessible through our web site is not, and should not be deemed to be, part of this prospectus. You should not rely on our website or any such information in making your decision whether to purchase our common stock.

We currently do not own or license any U.S. federal trademark registrations or applications. Some trademarks referred to in this prospectus are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

| -5- |

| Common Stock Outstanding | 57,593,414 shares(1) | |

| Shares of Common Stock underlying Warrants, Offered by Selling Stockholders | 10,382,500 shares(2) | |

| Use of Proceeds | We will not receive any proceeds from the sale of the common stock by the selling stockholders. We would, however, receive proceeds upon the exercise of the warrants held by the selling stockholders which, if such warrants are exercised in full, would be approximately $20,765,000. Proceeds, if any, received from the exercise of such warrants will be used for working capital and general corporate purposes. No assurances can be given that any of such warrants will be exercised. | |

| Quotation of Common Stock: | Our common stock is listed for quotation on the OTCQB Market operated by OTC Markets Group, Inc. (or OTCQB) under the ticker symbol “MTNB.” | |

| Risk Factors | An investment in our company is highly speculative and involves a significant degree of risk. See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

| (1) | Excludes: (i) outstanding options to purchase up to 8,320,694 shares of our common stock, as of September 30, 2016, at a weighted average exercise price of $0.85 per share; (ii) up to 2,523,519 shares of our common stock that are available, as of September 30, 2016, for future issuance under our 2013 Equity Compensation Plan (the “2013 Plan”); (iii) up to 3,000,000 shares of our common stock issuable pursuant to the terms of the merger agreement with Matinas Nanotechnologies, (iv) outstanding warrants to purchase up to 40,517,500 shares of common stock as of September 30, 2016, at a weighted average exercise price of $ 1.16 per share, and (v) 16,000,000 shares of common stock issuable upon conversion of shares of our outstanding Series A Preferred Stock as of September 30, 2016. |

| (2) | The Warrants have an exercise price of $2.00 per share. |

| -6- |

An investment in our common stock is speculative and involves a high degree of risk, including a risk of loss of your entire investment. You should carefully consider the risks described below and the other information in this prospectus before purchasing shares of our common stock. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties may also adversely impair our business operations. If any of the events described in the risk factors below actually occur, our business, financial condition or results of operations could suffer significantly. In such event, the value of our common stock could decline, and you could lose all or a substantial portion of the money that you pay for our common stock.

Risks Related to Our Financial Position and Need for Additional Capital

We have incurred significant losses since our inception. We expect to incur losses over the next several years and may never achieve or maintain profitability.

We have incurred significant operating losses in every year since inception and expect to incur net operating losses for the foreseeable future. Our net loss was $5.7 million and $7.1 million for the nine months ended September 30, 2016 and 2015, respectively and $9.1 million and $10.2 million for the years ended December 31, 2015 and 2014, respectively. As of September 30, 2016, we had an accumulated deficit of $33.3 million. We do not know whether or when we will become profitable. To date, we have not generated any revenues from product sales and have financed our operations primarily through private placements of our equity securities and, to a lesser extent, through funding from the National Institutes of Health, or the NIH. We have devoted substantially all of our financial resources and efforts to research and development, including preclinical studies and, beginning in 2014, clinical trials. We are still in the early stages of development of our product candidates, and we have not completed development of any product candidate. We expect to continue to incur significant expenses and operating losses over the next several years. Our net losses may fluctuate significantly from quarter to quarter and year to year. Net losses and negative cash flows have had, and will continue to have, an adverse effect on our stockholders’ deficit and working capital. We anticipate that our expenses will increase substantially if and as we:

| · | conduct our planned Phase 2a clinical trial of MAT2203, our lead product candidate; | |

| · | initiate and continue the research and development of our other product candidates and potential product candidates, including MAT2501; | |

| · | seek to discover and develop additional product candidates; | |

| · | seek regulatory approvals for any product candidates that successfully complete clinical trials; | |

| · | establish a sales, marketing and distribution infrastructure in the future to commercialize any products for which we may obtain regulatory approval; | |

| · | require the manufacture of larger quantities of product candidates for clinical development and potentially commercialization; | |

| · | maintain, expand and protect our intellectual property portfolio; | |

| · | hire additional clinical, quality control and scientific personnel; and | |

| · | add operational, financial and management information systems and personnel, including personnel to support our product development and planned future commercialization efforts and personnel and infrastructure necessary to help us comply with our obligations as a public company. |

Our ability to become and remain profitable depends on our ability to generate revenue. We do not expect to generate significant revenue unless and until we are able to obtain marketing approval for, and successfully commercialize, one or more of our product candidates. This will require us to be successful in a range of challenging activities, including completing preclinical testing and clinical trials of our product candidates, discovering additional product candidates, obtaining regulatory approval for these product candidates, manufacturing, marketing and selling any products for which we may obtain regulatory approval, satisfying any post-marketing requirements and obtaining reimbursement for our products from private insurance or government payors. We are only in the preliminary stages of most of these activities and have not yet commenced other of these activities. We may never succeed in these activities and, even if we do, may never generate revenues that are significant enough to achieve profitability.

| -7- |

Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to achieve profitability. If we are required by the U.S. Food and Drug Administration, or the FDA, or comparable non-U.S. regulatory authorities to perform studies in addition to those currently expected, or if there are any delays in completing our clinical trials or the development of any of our product candidates, our expenses could increase.

Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would decrease the value of our company and could impair our ability to raise capital, expand our business, maintain our research and development efforts, diversify our pipeline of product candidates or even continue our operations. A decline in the value of our company could also cause you to lose all or part of your investment.

Our recurring losses from operations have raised substantial doubt regarding our ability to continue as a going concern.

Our recurring losses from operations raise substantial doubt about our ability to continue as a going concern, and as a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements as of and for the year ended December 31, 2015 with respect to this uncertainty. This going concern opinion, and any future going concern opinion, could materially limit our ability to raise additional capital. We have incurred significant losses since our inception and have never been profitable, and it is possible we will never achieve profitability. To date, we have devoted our resources to developing MAT9001 and our lead anti-infective product candidates, MAT2203 and MAT2501 and other product candidates developed from our cochleate delivery technology platform, but none of these product candidates can be marketed until regulatory approval has been obtained. Meaningful revenues will likely not be available until, and unless, MAT2203 or any of our other product candidate is approved by the FDA or comparable regulatory agencies in other countries and successfully marketed, either by us or a partner. The perception that we may not be able to continue as a going concern may cause potential partners or investors to choose not to deal with us due to concerns about our ability to meet our contractual and financial obligations.

We will need substantial additional funding. If we are unable to raise capital when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts.

We expect our expenses to increase in connection with our ongoing activities, particularly as we conduct the Phase 2a clinical trial of MAT2203 and advance MAT2501 into clinical development, continue research and development, initiate clinical trials and, if development succeeds, seek regulatory approval of our product candidates. Our expenses could further increase if we initiate new research and preclinical development efforts for other product candidates. In addition, if we obtain regulatory approval for any of our product candidates, we expect to incur significant commercialization expenses related to product manufacturing, marketing, sales and distribution. Furthermore, we expect to incur significant additional costs associated with operating as a public company. Accordingly, we will need to obtain substantial additional funding in connection with our continuing operations. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and development programs or any future commercialization efforts.

We believe that our existing cash and cash equivalents of approximately $6.2 million as of September 30, 2016, will enable us to fund our operating expenses and capital expenditure requirements into April 2017. We have based this estimate on assumptions that may prove to be wrong in the future, and we could use our capital resources sooner than we currently expect. Changing circumstances could cause us to consume capital significantly faster than we currently anticipate, and we may need to spend more money than currently expected because of circumstances beyond our control. Our future capital requirements, both short-term and long-term, will depend on many factors, including:

| · | the progress, timing, costs and results of our Phase 2a clinical trial of MAT2203; | |

| · | the scope, progress, timing, costs and results of clinical trials of, and research and preclinical development efforts for, other product candidates, including MAT2501, and any future product candidates; | |

| · | our ability to enter into and the terms and timing of any collaborations, licensing or other arrangements that we may establish; |

| -8- |

| · | the number and development requirements of other product candidates that we pursue; | |

| · | the costs, timing and outcome of regulatory review of our product candidates by the FDA and comparable non-U.S. regulatory authorities; | |

| · | the costs and timing of future commercialization activities, including product manufacturing, marketing, sales and distribution, for any of our product candidates for which we receive marketing approval; | |

| · | the revenue, if any, received from commercial sales of our product candidates for which we receive marketing approval; | |

| · | our headcount growth and associated costs as we expand our research and development and establish a commercial infrastructure; | |

| · | the costs and timing of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending any intellectual property-related claims; | |

| · | the extent to which we acquire or in-license other products and technologies; | |

| · | the costs of operating as a public company; and | |

| · | the effect of competing technological and market developments. |

Identifying potential product candidates and conducting preclinical testing and clinical trials is a time-consuming, expensive and uncertain process that takes years to complete, and we may never generate the necessary data or results required to obtain regulatory approval and achieve product sales. In addition, our product candidates, if approved, may not achieve commercial success. Our commercial revenues, if any, will be derived from sales of products that we do not expect to be commercially available for many years, if at all. Accordingly, we will need to continue to rely on additional financing to achieve our business objectives. Adequate additional financing may not be available to us on acceptable terms, or at all. In addition, we may seek additional capital due to favorable market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans.

Raising additional capital may cause dilution to our stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate product revenues sufficient to achieve profitability, we expect to finance our cash needs through a combination of public or private equity offerings, debt financings, government or other third party funding, collaborations and licensing arrangements. We do not have any committed external source of funds other than limited grant funding from the NIH. To the extent that we raise additional capital through the sale of common stock, convertible securities or other equity securities, your ownership interest may be materially diluted, and the terms of these securities may include liquidation or other preferences and anti-dilution protections that could adversely affect your rights as a common stockholder. Debt financing and preferred equity financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends, that could adversely impact our ability to conduct our business. Securing additional financing could require a substantial amount of time and attention from our management and may divert a disproportionate amount of their attention away from day-to-day activities, which may adversely affect our management’s ability to oversee the development of our product candidates.

If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

Our stockholders may be subject to substantial dilution by exercises of outstanding options and warrants, conversion of our outstanding Series A Preferred Stock and by the future issuance of common stock to the former stockholders of Matinas Nanotechnologies pursuant to the terms of the merger agreement.

| -9- |

As of September 30, 2016, we had outstanding options to purchase an aggregate of 8,320,694 shares of our common stock at a weighted average exercise price of $0.85 per share and outstanding warrants to purchase an aggregate of 40,517,500 shares of our common stock at a weighted average exercise price of $ 1.16 per share and outstanding shares of Series A Preferred Stock which are convertible into 16,000,000 shares of our common stock. The conversion of our Series A Preferred Stock and exercise of such outstanding options and warrants will result in dilution of the value of our shares. In addition, pursuant to the terms of the merger agreement with.Matinas Nanotechnologies, we will be required to issue up to an additional 3,000,000 shares of our common stock upon the achievement of certain milestones. The milestone consideration consists of (i) 1,500,000 shares issuable upon the dosing of the first patient in a phase III trial sponsored by us for a product utilizing the cochleate delivery technology and (ii) 1,500,000 shares issuable upon FDA approval of the first NDA submitted by us for a product utilizing the cochleate delivery technology.

Our limited operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability.

We commenced active operations in 2013 and have a limited operating history. Our product candidates are in early stages of clinical development. We have not yet demonstrated our ability to successfully obtain regulatory approvals for any of our product candidates, manufacture a commercial scale product, or arrange for a third party to do so on our behalf, or conduct sales and marketing activities necessary for successful product commercialization. Consequently, any predictions you make about our future success or viability may not be as accurate as they could be if we had a longer operating history.

In addition, as a young business, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors. Even if we obtain regulatory approval, we will need to transition from a company with a research and development focus to a company capable of supporting commercial activities. We may not be successful in such a transition.

We expect our financial condition and operating results to continue to fluctuate significantly from quarter-to-quarter and year-to-year due to a variety of factors, many of which are beyond our control. Accordingly, you should not rely upon the results of any quarterly or annual periods as indications of future operating performance.

Risks Related to Product Development, Regulatory Approval, Manufacturing and Commercialization

Our research and development of product candidates is primarily focused on the identification of product candidates for the treatment of human fungal and bacterial infections. Our approach is unproven and we do not know whether we will be successful in our efforts to use our cochleate delivery platform to build a pipeline of product candidates or if we will be able to develop any products of commercial value.

Our scientific approach to the development of anti-infective medicines focuses on using our proprietary technology to deliver therapies for the treatment of human fungal and bacterial infections. Any product candidates that we develop may not be effective and we may not be successful in using our cochleate delivery platform to build a pipeline of anti-infective medications and progress these product candidates through clinical development for the treatment of any medical conditions.

Even if we are successful in continuing to build our pipeline, we may not be able to develop product candidates that are safe and effective. Our research programs may initially show promise in creating potential product candidates, yet fail to yield viable product candidates for further clinical development for a number of reasons, including as a result of being shown to have harmful side effects or other characteristics that indicate that they are unlikely to be products that will receive marketing approval and achieve market acceptance. Our research programs to identify new product candidates will require substantial technical, financial and human resources. In addition, we may focus our efforts and resources on one or more potential product candidates that ultimately prove to be unsuccessful. If we are unable to identify suitable additional compounds for preclinical and clinical development, our ability to develop product candidates and obtain product revenues in future periods could be compromised, which could result in significant harm to our financial position and adversely impact our stock price.

| -10- |

We cannot be certain that MAT2203, MAT2501 or any other product candidates that we may develop will receive regulatory approval, and without regulatory approval we will not be able to market any of our product candidates. Any delay in the regulatory review or approval of any of our product candidates will materially or adversely harm our business.

We expect to invest most of our capital in the development of MAT2203, MAT2501 and other product candidates derived from our cochleate delivery platform technology. Our ability to generate revenue related to product sales, which we do not expect will occur for at least the next several years, if ever, will depend on the successful development and regulatory approval of one or more of our product candidates. All of our product candidates require regulatory review and approval prior to commercialization. Any delays in the regulatory review or approval of our product candidates would delay market launch, increase our cash requirements and result in additional operating losses. This failure to obtain regulatory approvals would prevent our product candidate from being marketed and would have a material and adverse effect on our business.

The process of obtaining FDA and other required regulatory approvals, including foreign approvals, often takes many years and can vary substantially based upon the type, complexity and novelty of the products involved. Furthermore, this approval process is extremely complex, expensive and uncertain. We may be unable to submit any new drug application, or an NDA, in the United States or any marketing approval application in foreign jurisdictions for any of our products. If we submit an NDA including any amended NDA or supplemental NDA, to the FDA seeking marketing approval for any of our product candidates, the FDA must decide whether to accept or reject the submission for filing. We cannot be certain that any of these submissions will be accepted for filing and reviewed by the FDA, or that the marketing approval application submissions to any other regulatory authorities will be accepted for filing and review by those authorities. We cannot be certain that we will be able to respond to any regulatory requests during the review period in a timely manner, or at all, without delaying potential regulatory action. We also cannot be certain that any of our product candidates will receive favorable recommendations from any FDA advisory committee or foreign regulatory bodies or be approved for marketing by the FDA or foreign regulatory authorities. In addition, delays in approvals or rejections of marketing applications may be based upon many factors, including regulatory requests for additional analyses, reports, data and studies, regulatory questions regarding data and results, changes in regulatory policy during the period of product development and the emergence of new information regarding such product candidates.

Data obtained from preclinical studies and clinical trials are subject to different interpretations, which could delay, limit or prevent regulatory review or approval of any of our product candidates. Furthermore, regulatory attitudes towards the data and results required to demonstrate safety and efficacy can change over time and can be affected by many factors, such as the emergence of new information, including on other products, policy changes and agency funding, staffing and leadership. We do not know whether future changes to the regulatory environment will be favorable or unfavorable to our business prospects.

In addition, the environment in which our regulatory submissions may be reviewed changes over time. For example, average review times at the FDA for NDAs have fluctuated over the last ten years, and we cannot predict the review time for any of our submissions with any regulatory authorities. Review times can be affected by a variety of factors, including budget and funding levels and statutory, regulatory and policy changes. Moreover, in light of widely publicized events concerning the safety risk of certain drug products, regulatory authorities, members of the U.S. Government Accountability Office, medical professionals and the general public have raised concerns about potential drug safety issues. These events have resulted in the withdrawal of drug products, revisions to drug labeling that further limit use of the drug products and establishment of REMS measures that may, for instance, restrict distribution of drug products. The increased attention to drug safety issues may result in a more cautious approach by the FDA to clinical trials. Data from clinical trials may receive greater scrutiny with respect to safety, which may make the FDA or other regulatory authorities more likely to terminate clinical trials before completion, or require longer or additional clinical trials that may result in substantial additional expense and a delay or failure in obtaining approval or may result in approval for a more limited indication than originally sought.

| -11- |

We depend on technology owned or licensed to us by third parties, and the loss of access to this technology would terminate or delay the further development of our product candidates, injure our reputation or force us to pay higher royalties.

We rely completely on the cochleate delivery platform technology that we have licensed from Rutgers. The loss of our key technologies would seriously impair our business and future viability, and could result in delays in developing, introducing or maintaining our product candidates and formulations until equivalent technology, if available, is identified, licensed and integrated. In addition, any defects in the technology we license could prevent the implementation or impair the functionality of our product candidates or formulation, delay new product or formulation introductions or injure our reputation. If we are required to enter into license agreements with third parties for replacement technology, we could be subject to higher royalty payments.

Clinical drug development involves a lengthy and expensive process with uncertain outcomes that may lead to delayed timelines and increased cost, and may prevent us from being able to complete clinical trials.

Clinical testing is expensive, can take many years to complete, and its outcome is inherently uncertain. The results of preclinical and clinical studies of our product candidates may not be predictive of the results of later-stage clinical trials. For example, the positive results generated to date in Phase 1 clinical studies for MAT2203 do not ensure that either of our Phase 2 trials will demonstrate similar results. Product candidates in later stages of clinical trials may fail to show the desired safety and efficacy despite having progressed through preclinical studies and initial clinical trials. A number of companies in the pharmaceutical industry have suffered significant setbacks in advanced clinical trials due to lack of efficacy or adverse safety profiles, notwithstanding promising results in earlier studies, and we cannot be certain that we will not face similar setbacks.

We cannot be certain that the Phase 2 clinical trials for MAT2203 will be completed on schedule, or that any other future clinical trials for MAT2203 or any of our other product candidates, will begin on time, not need to be redesigned, enroll an adequate number of patients on time or be completed on schedule, if at all, or that any interim analyses with respect to such trials will be completed on schedule or support continued clinical development of the associated product candidate. The Phase 2a clinical trial for MAT2203 is being conducted in cooperation with and funded by the NIH and as a result can be delayed by the NIH for many reasons, including changing priorities in the NIH or other factors outside our control.

We could also encounter delays if a clinical trial is suspended or terminated by us upon recommendation of the data monitoring committee for such trial, by the IRBs of the institutions in which such trials are being conducted, or by the FDA or other regulatory authorities. Such authorities may suspend or terminate a clinical trial due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the FDA or other regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, failure to demonstrate a benefit from using a drug, changes in governmental regulations or administrative actions, or lack of adequate funding to continue the clinical trial.

If we experience delays in the completion of, or termination of, any clinical trial of our product candidates, the commercial prospects of our product candidates may be harmed, and our ability to generate revenue from the sale of any of these product candidates will be delayed. In addition, any delays in completing our clinical trials will increase our costs, slow down our product candidate development and approval processes, and jeopardize our ability to commence product sales and generate revenue. Any of these occurrences may significantly harm our business, financial condition and prospects significantly.

Delays in the commencement, enrollment and completion of our clinical trials could result in increased costs to us and delay or limit our ability to obtain regulatory approval for MAT2203 and our other product candidates.

Delays in the commencement, enrollment and completion of clinical trials could increase our product development costs or limit the regulatory approval of our product candidates. The commencement, enrollment and completion of clinical trials can be delayed for a variety of reasons, including:

| · | inability to force the NIH to commence or complete planned clinical studies, despite the existence of contractual agreements; | |

| · | inability to reach agreements on acceptable terms with prospective contract research organizations (CROs) and trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; | |

| · | inability to maintain necessary supplies of study drug and comparator to maintain predicted enrollment rates at clinical trial sites; |

| -12- |

| · | regulatory objections to commencing a clinical trial; | |

| · | inability to identify and maintain a sufficient number of trial sites, many of which may already be engaged in other clinical trial programs, including some that may be for the same indication as our product candidates; | |

| · | withdrawal of clinical trial sites from our clinical trials as a result of changing standards of care or the ineligibility of a site to participate in our clinical trials; | |

| · | inability to obtain institutional review board approval, including that within the NIH, to conduct a clinical trial; | |

| · | difficulty recruiting and enrolling subjects to participate in clinical trials for a variety of reasons, including meeting the enrollment criteria for our study and competition from other clinical trial programs for the same indication as our product candidates; | |

| · | inability to retain subjects in clinical trials due to the treatment protocol, personal issues, side effects from the therapy or lack of efficacy; and | |

| · | difficulty in importing and exporting clinical trial materials and study samples. |

We may not have or be able to obtain sufficient quantities of our products to meet our supply and clinical studies obligations and our business, financial condition and results of operation may be adversely affected.

To date, we have only developed limited in-house manufacturing capabilities for the cochleates needed for our MAT2203 and MAT2501 product candidates. If we do not develop a long term in-house manufacturing capability for the cochleates needed for our MAT2203 and MAT2501 product candidates sufficient to produce product for continued development and, if regulatory approval is obtained, then commercialization of these products, we will be dependent on a small number of third-party manufacturers for the manufacture of our product candidates. We may not have long-term agreements with any of these third parties, and if they are unable or unwilling to perform for any reason, we may not be able to locate alternative acceptable manufacturers or formulators or enter into favorable agreements with them. Any inability to acquire sufficient quantities of our products in a timely manner from these third parties could delay clinical trials and prevent us from developing our products in a cost-effective manner or on a timely basis. In addition, manufacturers of our product candidates are subject to cGMP and similar foreign standards and we would not have control over compliance with these regulations by our manufacturers. If one of our contract manufacturers fails to maintain compliance, the production of our products could be interrupted, resulting in delays and additional costs. In addition, if the facilities of such manufacturers do not pass a pre-approval or post-approval plant inspection, the FDA will not grant approval and may institute restrictions on the marketing or sale of our products.

We may be reliant on third party manufactures and suppliers to meet the demands of our clinical supplies. Delays in receipt of materials, scheduling, release, custom’s control, and regulatory compliance issues may adversely impact our ability to initiate, maintain, or complete clinical trials that we are sponsoring. Commercial manufacturing and supply agreements have not been established. Issues arising from scale-up, environmental controls, equipment requirements, or other factors, may have an adverse impact on our ability to manufacture our product candidates.

Even if we obtain regulatory approval for our product candidates, if we are unable to successfully commercialize our products, it will limit our ability to generate revenue and will materially adversely affect our business, financial condition and results of operations.

Even if we obtain regulatory approval for our product candidates, our long-term viability and growth depend on the successful commercialization of products which lead to revenue and profits. Pharmaceutical product development is an expensive, high risk, lengthy, complicated, resource intensive process. In order to succeed, among other things, we must be able to:

| · | identify potential drug product candidates; | |

| · | design and conduct appropriate laboratory, preclinical and other research; | |

| · | submit for and receive regulatory approval to perform clinical studies; | |

| · | design and conduct appropriate preclinical and clinical studies according to good laboratory and good clinical practices; |

| -13- |

| · | select and recruit clinical investigators; | |

| · | select and recruit subjects for our studies; | |

| · | collect, analyze and correctly interpret the data from our studies; | |

| · | submit for and receive regulatory approvals for marketing; and | |

| · | manufacture the drug product candidates according to cGMP. |

The development program with respect to any given product will take many years and thus delay our ability to generate profits. In addition, potential products that appear promising at early stages of development may fail for a number of reasons, including the possibility that the products may require significant additional testing or turn out to be unsafe, ineffective, too difficult or expensive to develop or manufacture, too difficult to administer, or unstable. Failure to successfully commercialize our products will adversely affect our business, financial condition and results of operations.

If our preclinical and clinical studies do not produce positive results, if our clinical trials are delayed or if serious side effects are identified during such studies or trials, we may experience delays, incur additional costs and ultimately be unable to commercialize our product candidates.

Before obtaining regulatory approval for the sale of our product candidates, we must conduct, generally at our own expense, extensive preclinical tests to demonstrate the safety of our product candidates in animals, and clinical trials to demonstrate the safety and efficacy of our product candidates in humans. Preclinical and clinical testing is expensive, difficult to design and implement and can take many years to complete. A failure of one or more of our preclinical studies or clinical trials can occur at any stage of testing. We may experience numerous unforeseen events during, or as a result of, preclinical testing and the clinical trial process that could delay or prevent our ability to obtain regulatory approval or commercialize our product candidates, including:

| · | our preclinical tests or clinical trials may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional preclinical testing or clinical trials or we may abandon projects that we expect to be promising; | |

| · | regulators or institutional review boards may not authorize us to commence a clinical trial or conduct a clinical trial at a prospective trial site; | |

| · | conditions imposed on us by the FDA or any non-U.S. regulatory authority regarding the scope or design of our clinical trials may require us to resubmit our clinical trial protocols to institutional review boards for re-inspection due to changes in the regulatory environment; | |

| · | the number of patients required for our clinical trials may be larger than we anticipate or participants may drop out of our clinical trials at a higher rate than we anticipate; | |

| · | our third party contractors or clinical investigators may fail to comply with regulatory requirements or fail to meet their contractual obligations to us in a timely manner; | |

| · | we might have to suspend or terminate one or more of our clinical trials if we, the regulators or the institutional review boards determine that the participants are being exposed to unacceptable health risks; | |

| · | regulators or institutional review boards may require that we hold, suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements; | |

| · | the cost of our clinical trials may be greater than we anticipate; | |

| · | the supply or quality of our product candidates or other materials necessary to conduct our clinical trials may be insufficient or inadequate or we may not be able to reach agreements on acceptable terms with prospective clinical research organizations; and | |

| · | the effects of our product candidates may not be the desired effects or may include undesirable side effects or the product candidates may have other unexpected characteristics. |

In addition, if we are required to conduct additional clinical trials or other testing of our product candidates beyond those that we currently contemplate, if we are unable to successfully complete our clinical trials or other testing, if the results of these trials or tests are not positive or are only modestly positive or if there are safety concerns, we may:

| · | be delayed in obtaining, or may not be able to obtain, marketing approval for one or more of our product candidates; |

| -14- |

| · | obtain approval for indications that are not as broad as intended or entirely different than those indications for which we sought approval; or | |

| · | have the product removed from the market after obtaining marketing approval. |

Our product development costs will also increase if we experience delays in testing or approvals. We do not know whether any preclinical tests or clinical trials will be initiated as planned, will need to be restructured or will be completed on schedule, if at all. Significant preclinical or clinical trial delays also could shorten the patent protection period during which we may have the exclusive right to commercialize our product candidates. Such delays could allow our competitors to bring products to market before we do and impair our ability to commercialize our products or product candidates.

If we cannot enroll enough patients to complete our clinical trials, such failure may adversely affect our business, financial condition and results of operations.

The completion rate of clinical studies of our products is dependent on, among other factors, the patient enrollment rate. Patient enrollment is a function of many factors, including:

| · | investigator identification and recruitment; | |

| · | regulatory approvals to initiate study sites; | |

| · | patient population size; | |

| · | the nature of the protocol to be used in the trial; | |

| · | patient proximity to clinical sites; | |

| · | eligibility criteria for the study; | |

| · | competition from other companies’ clinical studies for the same patient population; and | |

| · | ability to obtain comparator drug/device. |

We believe our procedures for enrolling patients have been appropriate; however, delays in patient enrollment would increase costs and delay ultimate commercialization and sales, if any, of our products. Such delays could materially adversely affect our business, financial condition and results of operations.

If we are not successful in discovering, developing and commercializing additional product candidates, our ability to expand our business and achieve our strategic objectives would be impaired.

A key element of our strategy is to leverage our cochleate drug delivery technology platform to discover, develop and commercialize a portfolio of product candidates. We are seeking to do so through our internal research programs and are exploring, and may also explore in the future, strategic partnerships for the development of new products. Other than MAT2203 and MAT2501, all of our other potential cochleate-related product candidates remain in the discovery and preclinical stages.

Research programs to identify product candidates require substantial technical, financial and human resources, whether or not any product candidates are ultimately identified. Our research programs may initially show promise in identifying potential product candidates, yet fail to yield product candidates for clinical development for many reasons, including the following:

| · | the research methodology used may not be successful in identifying potential product candidates; | |

| · | we may be unable to identify viable product candidates in our screening campaigns; | |

| · | competitors may develop alternatives that render our product candidates obsolete; | |

| · | product candidates we develop may nevertheless be covered by third parties’ patents or other exclusive rights; | |

| · | a product candidate may, on further study, be shown to have harmful side effects or other characteristics that indicate it is unlikely to be effective or otherwise does not meet applicable regulatory criteria; | |

| · | a product candidate may not be capable of being produced in commercial quantities at an acceptable cost, or at all; | |

| · | a product candidate may not be accepted as safe and effective by patients, the medical community or third-party payors; and |

| -15- |

| · | the development of bacterial resistance to potential product candidates may render them ineffective against target infections. |

If we are unsuccessful in identifying and developing additional product candidates, our potential for growth may be impaired.

Even if we receive regulatory approval for MAT2203, MAT2501 or any other product candidates we may develop, we still may not be able to successfully commercialize it and the revenue that we generate from its sales, if any, may be limited.

If approved for marketing, the commercial success of MAT2203, MAT2501 or any other product candidates we may develop will depend upon its acceptance by the medical community, including physicians, patients and health care payors. The degree of market acceptance of MAT2203, MAT2501 or such other product candidate will depend on a number of factors, including:

| · | demonstration of clinical safety and efficacy of such product candidate; | |

| · | relative convenience and ease of administration; | |

| · | the prevalence and severity of any adverse effects; | |

| · | the willingness of physicians to prescribe such product candidates and of the target patient population to try new therapies; | |

| · | pricing and cost-effectiveness; | |

| · | the inclusion or omission of such product candidate in applicable treatment guidelines; | |

| · | the effectiveness of our or any future collaborators’ sales and marketing strategies; | |

| · | limitations or warnings contained in FDA-approved labeling; | |

| · | our ability to obtain and maintain sufficient third-party coverage or reimbursement from government health care programs, including Medicare and Medicaid, private health insurers and other third-party payors; and | |

| · | the willingness of patients to pay out-of-pocket in the absence of third-party coverage or reimbursement. |

If MAT2203, MAT2501, or any other product candidates we may develop is approved, but does not achieve an adequate level of acceptance by physicians, health care payors and patients, we may not generate sufficient revenue and we may not be able to achieve or sustain profitability. Our efforts to educate the medical community and third-party payors on the benefits of such product candidate may require significant resources and may never be successful.

In addition, even if we obtain regulatory approvals, the timing or scope of any approvals may prohibit or reduce our ability to commercialize such product candidate successfully. For example, if the approval process takes too long, we may miss market opportunities and give other companies the ability to develop competing products or establish market dominance. Any regulatory approval we ultimately obtain may be limited or subject to restrictions or post-approval commitments that render such product candidate not commercially viable. For example, regulatory authorities may approve such product candidate for fewer or more limited indications than we request, may not approve the price we intend to charge for such product candidate, may grant approval contingent on the performance of costly post-marketing clinical trials, or may approve such product candidate with a label that does not include the labeling claims necessary or desirable for the successful commercialization of that indication. Further, the FDA may place conditions on approvals including potential requirements or risk management plans and the requirement for a Risk Evaluation and Mitigation Strategy (“REMS”) to assure the safe use of the drug. If the FDA concludes a REMS is needed, the sponsor of the NDA must submit a proposed REMS; the FDA will not approve the NDA without an approved REMS, if required. A REMS could include medication guides, physician communication plans, or elements to assure safe use, such as restricted distribution methods, patient registries and other risk minimization tools. Any of these limitations on approval or marketing could restrict the commercial promotion, distribution, prescription or dispensing of such product candidate. Moreover, product approvals may be withdrawn for non-compliance with regulatory standards or if problems occur following the initial marketing of the product. Any of the foregoing scenarios could materially harm the commercial success of such product candidate.

| -16- |

We currently have no sales and marketing organization. If we are unable to establish satisfactory sales and marketing capabilities, we may not successfully commercialize any of our product candidates, if regulatory approval is obtained.

At present, we have no sales or marketing personnel. In order to commercialize products that are approved for commercial sales, we must either develop a sales and marketing infrastructure or collaborate with third parties that have such commercial infrastructure. If we elect to develop our own sales and marketing organization, we do not intend to begin to hire sales and marketing personnel until the time of NDA submission to the FDA at the earliest, and we do not intend to establish our own sales organization in the United States until shortly prior to FDA approval of MAT2203, MAT2501 or any of our other product candidates.

We may not be able to establish a direct sales force in a cost-effective manner or realize a positive return on this investment. In addition, we will have to compete with established and well-funded pharmaceutical and biotechnology companies to recruit, hire, train and retain sales and marketing personnel. Factors that may inhibit our efforts to commercialize MAT2203, MAT2501 or any of our other product candidates in the United States without strategic partners or licensees include:

| · | our inability to recruit and retain adequate numbers of effective sales and marketing personnel; | |

| · | the inability of sales personnel to obtain access to or persuade adequate numbers of physicians to prescribe our future products; | |

| · | the lack of complementary products to be offered by sales personnel, which may put us at a competitive disadvantage relative to companies with more extensive product lines; and | |

| · | unforeseen costs and expenses associated with creating an independent sales and marketing organization. |

If we are not successful in recruiting sales and marketing personnel or in building a sales and marketing infrastructure, or if we do not successfully enter into appropriate collaboration arrangements, we will have difficulty successfully commercializing MAT2203, MAT2501 or any other product candidates we may develop, which would adversely affect our business, operating results and financial condition. Outside the United States, we may commercialize our product candidates by entering into collaboration agreements with pharmaceutical partners. We may not be able to enter into such agreements on terms acceptable to us or at all. In addition, even if we enter into such relationships, we may have limited or no control over the sales, marketing and distribution activities of these third parties. Our future revenues may depend heavily on the success of the efforts of these third parties.

We face competition from other biotechnology and pharmaceutical companies and our operating results will suffer if we fail to compete effectively.

The biotechnology and pharmaceutical industries are intensely competitive and subject to rapid and significant technological change. We have competitors in a number of jurisdictions, many of which have substantially greater name recognition, commercial infrastructures and financial, technical and personnel resources than we have. Established competitors may invest heavily to quickly discover and develop novel compounds that could make MAT2203, MAT2501 or any other product candidates we may develop obsolete or uneconomical. Any new product that competes with an approved product may need to demonstrate compelling advantages in efficacy, cost, convenience, tolerability and safety to be commercially successful. Other competitive factors, including generic competition, could force us to lower prices or could result in reduced sales. In addition, new products developed by others could emerge as competitors to MAT2203, MAT2501 or any of our other product candidates. If we are not able to compete effectively against our current and future competitors, our business will not grow and our financial condition and operations will suffer.

We face competition from many different sources, including commercial pharmaceutical and biotechnology enterprises, academic institutions, government agencies and private and public research institutions. We face competition with respect to our current product candidates and we will face competition with respect to any product candidates that we may seek to develop or commercialize in the future. Our current and potential competitors in the anti-fungal marketplace for which we are developing MAT2203 include Merck & Co. Inc., Astellas Pharma US, Pfizer, Inc., Novartis AG, Viamet Inc., Cidara Therapeutics, Scynexis Inc. and Sigma Tau. With respect to competition for MAT2501 in the anti-bacterial marketplace, our current and potential competitors include Insmed Incorporated, Merck & Co., Tetraphase Pharmaceuticals, Inc., Achaogen, Inc., Raptor Pharmaceuticals and The Medicines Company.

| -17- |

Even if we obtain marketing approval for MAT2203, MAT2501 or any other product candidates that we may develop, we will be subject to ongoing obligations and continued regulatory review, which may result in significant additional expense. Additionally, our product candidates could be subject to labeling and other restrictions and withdrawal from the market and we may be subject to penalties if we fail to comply with regulatory requirements or if we experience unanticipated problems with our future products.

Even if we obtain United States regulatory approval of MAT2203, MAT2501 or any other product candidates that we may develop, the FDA may still impose significant restrictions on its indicated uses or marketing or the conditions of approval, or impose ongoing requirements for potentially costly and time-consuming post-approval studies, and post-market surveillance to monitor safety and efficacy. Our future products will also be subject to ongoing regulatory requirements governing the manufacturing, labeling, packaging, storage, distribution, safety surveillance, advertising, promotion, recordkeeping and reporting of adverse events and other post-market information. These requirements include registration with the FDA, as well as continued compliance with current Good Clinical Practices regulations, or cGCPs, for any clinical trials that we conduct post-approval. In addition, manufacturers of drug products and their facilities are subject to continuous review and periodic inspections by the FDA and other regulatory authorities for compliance with current good manufacturing practices, cGMP, requirements relating to quality control, quality assurance and corresponding maintenance of records and documents.

The FDA has the authority to require a REMS, as part of an NDA or after approval, which may impose further requirements or restrictions on the distribution or use of an approved drug, such as limiting prescribing to certain physicians or medical centers that have undergone specialized training, limiting treatment to patients who meet certain safe-use criteria or requiring patient testing, monitoring and/or enrollment in a registry.

With respect to sales and marketing activities by us or any future partner, advertising and promotional materials must comply with FDA rules in addition to other applicable federal, state and local laws in the United States and similar legal requirements in other countries. In the United States, the distribution of product samples to physicians must comply with the requirements of the U.S. Prescription Drug Marketing Act. Application holders must obtain FDA approval for product and manufacturing changes, depending on the nature of the change. We may also be subject, directly or indirectly through our customers and partners, to various fraud and abuse laws, including, without limitation, the U.S. Anti-Kickback Statute, U.S. False Claims Act, and similar state laws, which impact, among other things, our proposed sales, marketing, and scientific/educational grant programs. If we participate in the U.S. Medicaid Drug Rebate Program, the Federal Supply Schedule of the U.S. Department of Veterans Affairs, or other government drug programs, we will be subject to complex laws and regulations regarding reporting and payment obligations. All of these activities are also potentially subject to U.S. federal and state consumer protection and unfair competition laws. Similar requirements exist in many of these areas in other countries.

In addition, our product labeling, advertising and promotion would be subject to regulatory requirements and continuing regulatory review. The FDA strictly regulates the promotional claims that may be made about prescription products. In particular, a product may not be promoted for uses that are not approved by the FDA as reflected in the product’s approved labeling. If we receive marketing approval for our product candidates, physicians may nevertheless legally prescribe our products to their patients in a manner that is inconsistent with the approved label. If we are found to have promoted such off-label uses, we may become subject to significant liability and government fines. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant sanctions, including revocation of its marketing approval. The federal government has levied large civil and criminal fines against companies for alleged improper promotion and has enjoined several companies from engaging in off-label promotion. The FDA has also requested that companies enter into consent decrees of permanent injunctions under which specified promotional conduct is changed or curtailed.

| -18- |